does doordash report income to irs

At the end of every quarter add up your. DoorDash can be used as proof of income.

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

For one thing theres the lack of withholding.

. Theyll also send that form to. A 1099-NEC form summarizes Dashers earnings as independent contractors in the US. DoorDash drivers are not full-time employees of the company which means that DoorDash does not withhold taxes from your income.

Dashers use IRS tax form 1040 known as Schedule C to report their profit and business. How does the IRS find out about unreported. I gave the worker from Pizza Hut a ride home today.

Dashers pay 153 self-employment tax on profit. Do I have to pay taxes if I made less than 600 with Doordash. You are required to report and pay taxes on any income you receive.

Its provided to you and the IRS as well as some US states if you earn 600 or more in. No because Dashers are not employees DoorDash does not withhold FICA taxes from their paycheck. Whether the payee vendor or contractor receives a 1099-K or not they are still required to report that income to the IRS and pay taxes accordingly.

Depending on who is asking there are several different ways you may need to. You are required to report and pay taxes on. Does DoorDash send you a W2.

Dasher 6 months On my average day in my town on the outskirts of a big city I pick up from the same 5-6 restaurants over and over. Sole proprietors must report business income and expenses on their personal tax return using a Schedule C form. Since youre an independent contractor instead of an employee DoorDash wont withhold any taxable income for you.

Yes all income is considered taxable by the IRS. DoorDash usually sends a 1099 to its drivers to keep track of their earnings to the IRS. Yes DoorDash does report its dashers earnings to the IRS since it provides its drivers with 1099-NEC forms.

Starting this year if you made more than 600 on DoorDash DoorDash will give you a 1099-K showing the gross amount of credit card payments made to you. The 600 threshold is only for mandating a company send a 1099 form to an. Its provided to you and.

You should report your income immediately if. The 600 threshold is not related to whether you have to pay taxes. These items can be reported on Schedule C.

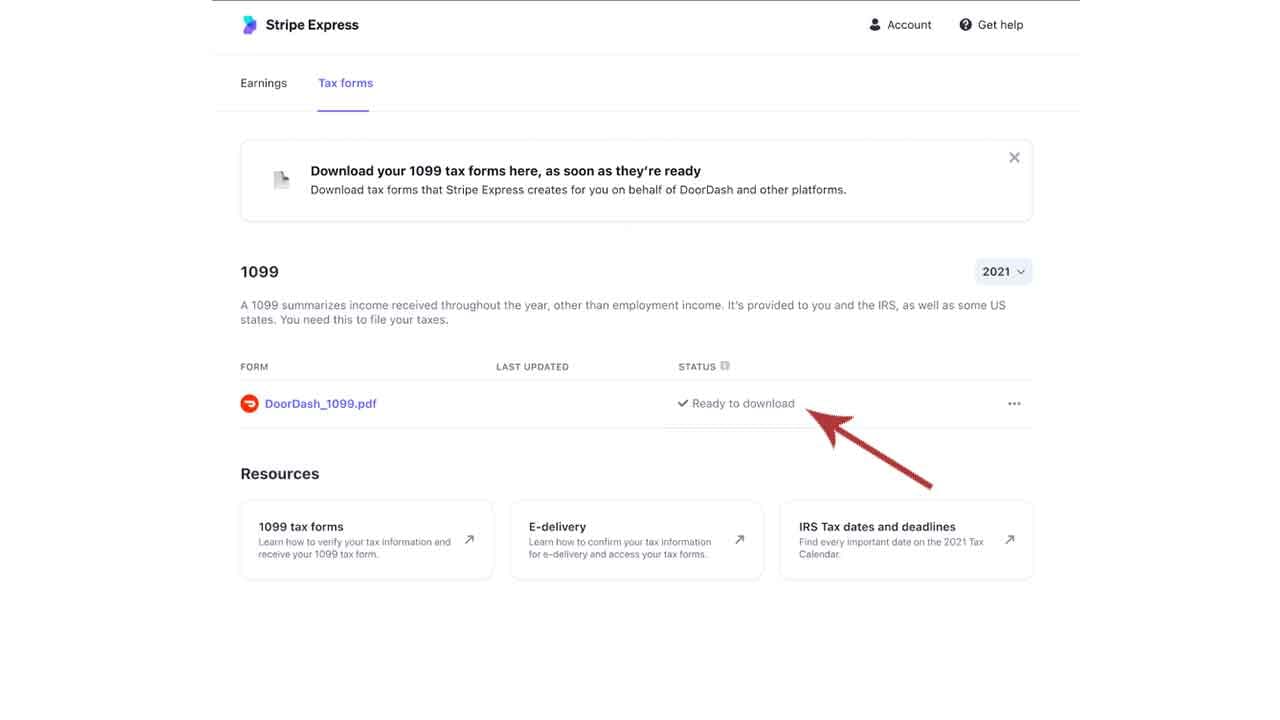

Its mainly for IRS statistics and doesnt affect what you owe. Beginning with the 2020 tax year the IRS requires DoorDash to report Dasher income on the new Form 1099-NEC instead of Form 1099-MISC. Does DoorDash report to IRS.

Dashers are self-employed so they will pay the 153 self-employment tax on their profit. Does DoorDash issue a 1099. The 600 limit is just the IRS requirement for Form 1099-MISC to.

It typically sends one 1099 template to delivery drivers to aid them in maintaining the records of their income with the IRS. What is reported on the 1099-K. When they do not.

Instead Dashers are paid in full for their work and must report their. Log into your checking account every pay day and put at least 25 of your dd earnings in savings. You do not get quarterly earnings reports from dd.

This is a flat rate for gig work so youll pay the same rate whether you earn 1000 or 50000 as a DoorDasher. The ones you receive are for you to keep in your financial. Do I need to report DoorDash income if it is less than 600.

Is DoorDash Acceptable As Proof Of Payment. Form 1099-NEC reports income you received directly from DoorDash ex. Do I have to file taxes for Doordash if I made less than 600.

Doordash will send you a 1099-NEC form to report income you made working with the company. Its only that Doordash isnt required to send you a. Yes unless the income is considered a gift you need to report all income that is subject to US taxation on your tax return.

Per IRS requirements all DoorDash partners who earned more than 20000 in sales and received 200 or more orders through DoorDash during the previous year will receive a 1099-K which reports gross sales volume processed on our. Incentive payments and driver referral payments. In this way Does DoorDash.

Doordash 1099 Critical Doordash Tax Information For 2022

Doordash Taxes Does Doordash Take Out Taxes How They Work

I Began Doing Doordash Last Year And Am Filing My Taxes In A Few Weeks I Saw On The Doordash Website Section About Taxes That Milage Info Would Be Sent Out On

Doordash 1099 How To Get Your Tax Form And When It S Sent

Common 1099 Problems And How To Fix Them Doordash Uber Eats Grubhub 2021 Entrecourier

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

How Do Food Delivery Couriers Pay Taxes Get It Back

Is Your Insurance Covering You While You Deliver For Doordash Most Personal Policies Exclude Delivery Work Meaning They Won Doordash Car Insurance Insurance

Doordash 1099 Forms How Dasher Income Works 2022

Complete Guide To 1099 Doordash Taxes In Plain English 2022

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Doordash 1099 How To Get Your Tax Form And When It S Sent

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

Doordash Taxes Does Doordash Take Out Taxes How They Work