what is hospital indemnity high plan

Hospital indemnity insurance supplements your existing health insurance coverage by helping pay expenses for hospital stays. A Hospital Indemnity Insurance policy is flexible and can be tailored to your needs and budget.

Different Types Of Health Insurance Plans

The Aflac Hospital Indemnity Insurance plan pays 1400.

. Hospital Indemnity Insurance Benefits. It also provides a 3000 lump sum outpatient surgical benefit. This form of supplemental insurance pays you a predetermined benefit amount per day for each hospital confinement.

Also known as hospital confinement indemnity insurance or simply hospital insurance it is considered a type of supplemental insurance. Hospital indemnity insurance is an insurance plan you can purchase in addition to your health insurance plan sponsored by your employer the government or a private insurer. What is a hospital indemnity plan.

The amount of the benefit is based on the covered expenses and treatments covered by the employees plan. Any payment the plan makes is in addition to the benefits your employees receive from their health plan. They usually pay you this daily benefit amount for up to a year.

What Does a Hospital Indemnity. The insured has a high fever and goes to the emergency room. It pays fixed daily dollar benefits for covered services without regard to the health care providers actual charges.

To apply just answer. Written by Terry Turner. With MetLife youll have a comprehensive plan which will provide lump sum cash payments in addition to any other payments you may receivefrom your medical plan.

Hospital indemnity insurance also known as hospital confinement insurance or simply hospital insurance is supplemental medical insurance coverage that pays benefits if you are hospitalized. After that Medicare will begin to pay a portion or all of the charges depending on the number of days spent in the hospital. Hospital indemnity insurance helps by putting recovery first over hospital bills.

If you currently offer or are considering moving toward a high-deductible health plan Hospital Indemnity Insurance is a cost-effective way to round out your coverage options. This type of plan typically provides a cash benefit for each day confined in the hospital and they generally do not have a deductible or waiting period. 4 While health insurance pays for medical services after copays co-insurance and deductibles are met hospital indemnity insurance pays you if you are hospitalized.

It can help cover out-of-pocket hospitalization costs that Original Medicare or a Medicare Advantage plan will not. Aflac Hospital Indemnity Insurance plan is selected. The average price of a hospital stay for seniors is nearly 15000 for a five-day visit.

Hospital Indemnity insurance can help lower your costs if you have a hospital stay. Most people purchase a hospital indemnity plan in addition to other coverage like a major medical plan Medicare or Medicare Advantage. There are no networks copays deductibles or coinsurance restrictions.

To learn more about hospital indemnity insurance and ask specific questions call 888-855-6837 to speak with a licensed agent. Guardians Hospital Indemnity benefit can help pay for out-of-pocket costs associated with being hospitalized in addition to your medical coverage and can give you more of a financial safety net for unplanned expenses brought on by a hospital stay. Hospital Indemnity Insurance Benefits With MetLife youll have a choice of two comprehensive plans called the Low Plan and High Plan which provide lump sum cash payments in addition to any other payments you may receive from your medical plan.

Hospital indemnity insurance is coverage you can add to your existing health insurance plan. Hospital indemnity insurance can also be referred to as hospital insurance. The insured is released after two days.

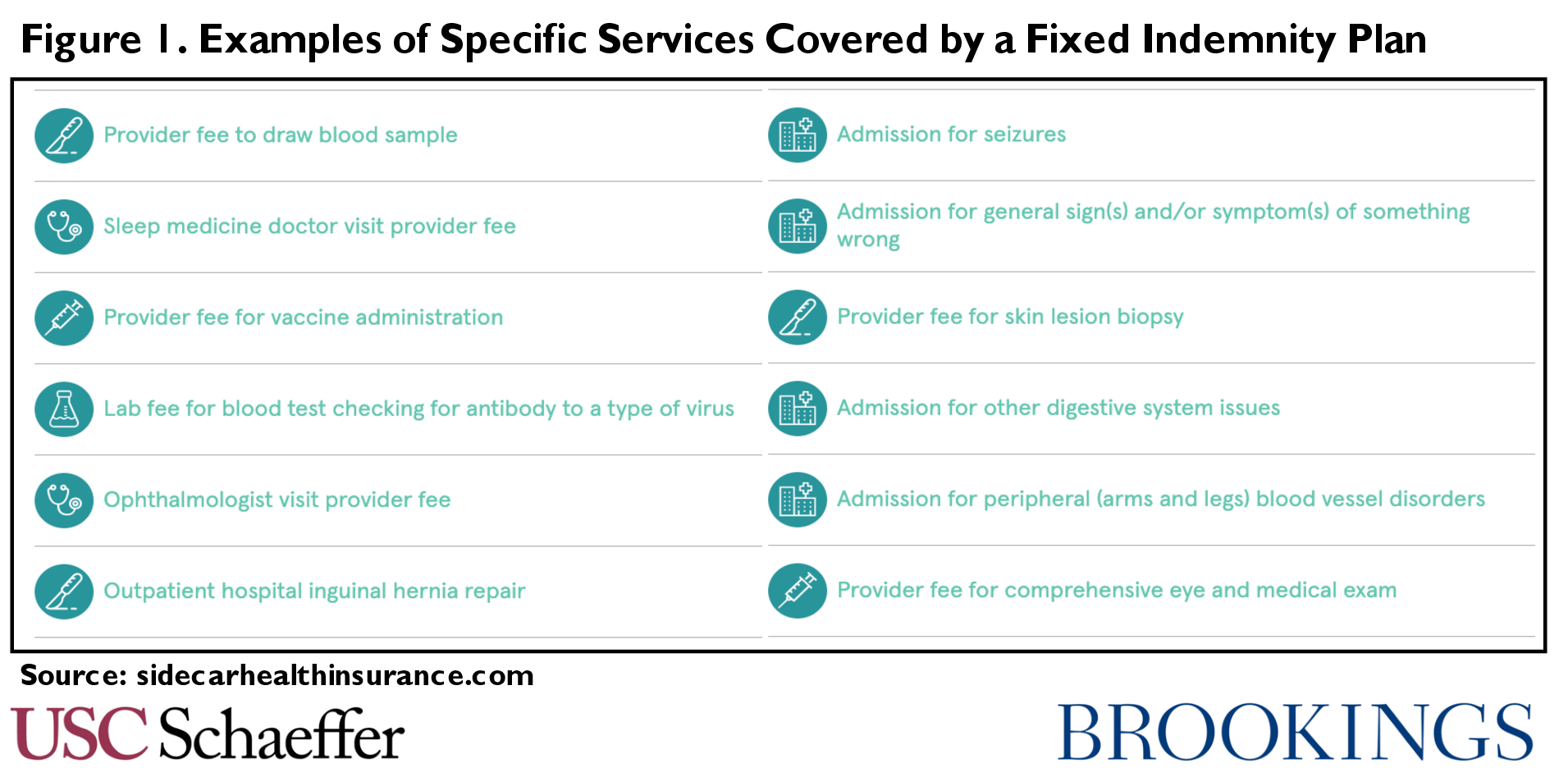

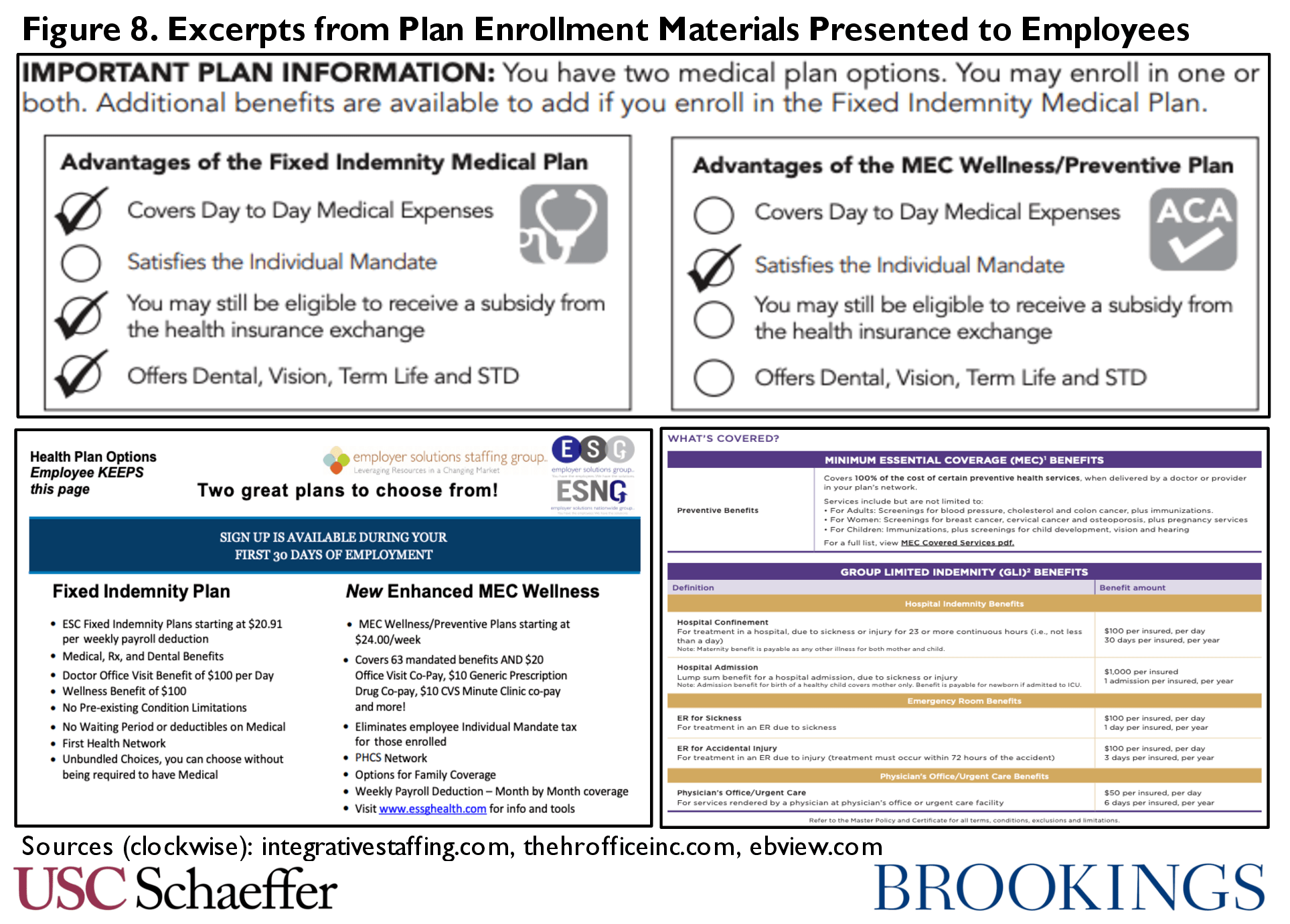

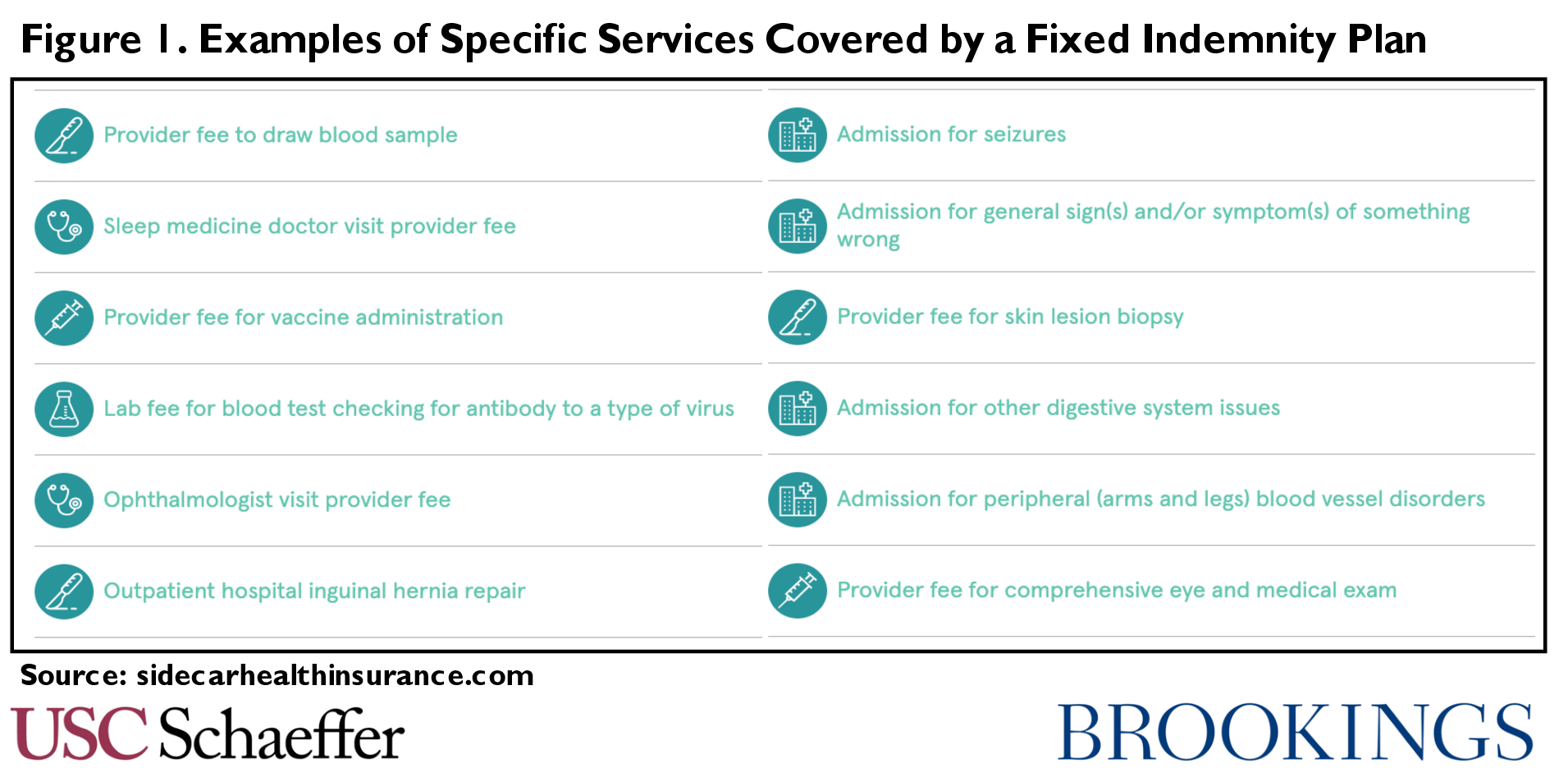

Hospital Indemnity or Fixed Indemnity FI plans are a type of health benefits coverage that offers financial protection for commonly needed medical services including hospital and doctor benefits. Essentially hospital indemnity insurance can help provide protection or assistance with expensive bills that can add up after a visit to the hospital. Get a Free 2022 Open Enrollment Guide.

This plan provides limited benefits. Complement a high-deductible health plan. Payments are made directly to you even if you did not actually incur any out-of-pocket expenses.

Hospital Indemnity insurance also called Hospitalization insurance or Hospital insurance is a plan that pays you benefits when you are confined to a hospital whether for planned or unplanned reasons or for other medical services depending on the policy. For example under Medicare Part A a patient must pay their deductible before Medicare starts to pay their portion. No matter which hospital you choose youll be covered.

There is a hospital indemnity plan available for 50 per month which provides a lump sum hospital confinement of 6350. Hospital indemnity insurance is a type of policy that helps cover the costs of hospital admission that may not be covered by other insurance. A hospital indemnity plan can help cover the costs youd be responsible for even with Medicare coverage.

That means that when you experience a covered medical event Hospital Indemnity or Fixed Indemnity plans pay a set fee directly to you or a provider. Insureds can use these benefits to help safeguard against the expenses that medical insurance may not cover like co-pays deductibles or any other living expense that may arise. Hospital indemnity insurance can help ease your stress about hospital bills so you can focus more on getting better.

The benefits payments are not intended to. The Aetna Hospital Indemnity Plan is a hospital confinement indemnity plan. Many insurance carriers offer Hospital Indemnity plans to help fill gaps in your medical coverage by providing cash to help.

Our Hospital Indemnity Protection Plan is insurance that pays a lump-sum benefit directly to a covered employee after a hospital stay and related expenses. Hospital indemnity insurance is an additional insurance policy you can buy that pays you a fixed amount for each day you spend in a hospital. If you wanted to stay at the 616 budget you could select the 50 per month hospital indemnity insurance plan and purchase the Bronze plan.

Control your benefit costs. Here are just some of the covered benefitsservices when an accident or illness puts you in the hospital. Physician admits the insured into the hospital.

Hospital Indemnity Insurance HI provides cash benefits for each day an employee is confined in a hospital for a covered illness or injury. Depending on the plan hospital indemnity insurance gives you cash payments to help you pay for the added expenses that may come while you recover. What Is a Hospital Indemnity Insurance Plan.

If you are looking for extra financial protection against the unexpectedly high costs of hospitalization then a hospital indemnity plan may be worth considering especially if you have a high-deductible major medical plan.

Sun Life Offers Hospital Indemnity Insurance With New Extended Hospitalization Coverage To Help Members Close Coverage Gaps Sun Life

Hospital Indemnity Insurance Through Our Fmo Senior Market Advisors

Hospital Indemnity Insurance The Hartford

How Hospital Indemnity Insurance Works Guardian

Is Hospital Indemnity Insurance Worth It Glg America

Health Insurance Cover Is Surely Both A Short Term And Also Lasting Investment Prior To Individual Health Insurance Best Health Insurance Life Insurance Sales

Fixed Indemnity Health Coverage Is A Problematic Form Of Junk Insurance Usc Schaeffer

Fixed Indemnity Health Coverage Is A Problematic Form Of Junk Insurance Usc Schaeffer

The Ultimate Medicare Blog Medicare Plan Finder Health Care Coverage How To Plan Medicare

Samrataul Hdfc Life Policy Smart Skill By Samrataul Life Insurance Companies Life Insurance Term Insurance

Kemper Health Hospital Indemnity Insurance

Dangers Of Fixed Indemnity Plans But Not In The Eyes Of The Court Triage Cancer Finances Work Insurance

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

Why Hospital Indemnity Insurance Should Be Part Of Every Coverage Portfolio Allstate Benefits

Hospital Indemnity Insurance What You Need To Know

4 Facts You Need To Know About Hospital Indemnity Insurance

What Is Hospital Indemnity Insurance And Do I Need It American Income Life Insurance Co